What do the letters in my tax code mean?

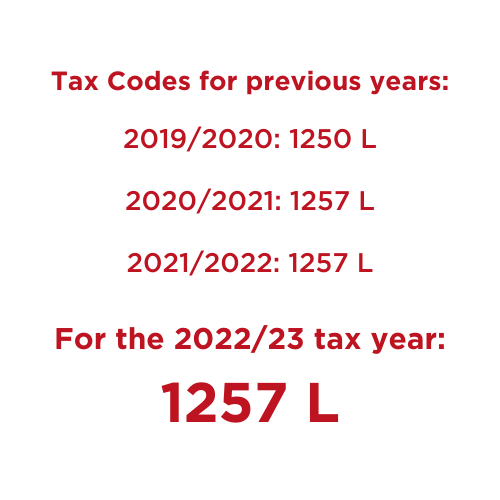

If you see the letter L at the end of your tax code, it means you’re entitled to the standard tax-free Personal Allowance for your income from the job your code refers to.

Depending on your personal situation, though, you might find that your tax code ends differently. If this happens, it means you’re not getting the same Personal Allowance that most people get for this job or pension. Don’t panic if you don’t get an L tax code, though. It’s not always bad news. If you’re using the Marriage Allowance system, for example, your tax code will typically end in an M or N. All this means is that you and your spouse are making good use of your Personal Allowances to bring down your overall tax bill.

Here’s a basic rundown of the letters HMRC generally uses in tax codes, and what they actually mean:

The K Code: your deductions for company benefits, state pension or tax owed from previous years are greater than your Personal Allowance.

The L Code: you qualify for the normal tax-free Personal Allowance.

The M Code: your partner has transferred up to 10% of their Personal Allowance to you.

The N Code: you've transferred up to 10% of your Personal Allowance to your spouse.

The S Code: you're eligible for the Scottish rate of Income Tax.

The C Code: you're eligible for the Welsh rate of Income Tax.

The Y Code: you were born before the 6th of April 1938. This means your Personal Allowance is higher.

The T Code: your Personal Allowance has some other calculations factored into it.

The 0T Code: you've used up your Personal Allowance or your new employer doesn't have the information they need to work out your proper tax code.

The BR Code: your income for this job or pension is taxed at the basic rate from the very first penny. This can happen if you've got another job with your Personal Allowance attached to it, for example.

The D0 Code: you're being taxed at the higher rate on all the money from this job or pension.

The D1 Code: all of the money from this job or pension is being taxed at the additional rate.

The NT Code: you don't pay tax on this income at all.

The W1, M1 or X Code: you’ve got an emergency tax code for this job or pension.

Some of the tax codes listed above are less common than others, but you still need to be aware of what they mean if they crop up. The K code, for instance, is only used when deductions from your Personal Allowance have actually brought the amount you can earn tax-free in a year below £0! That kind of situation’s not much fun, because it’s like owing tax on income you haven’t even earned!

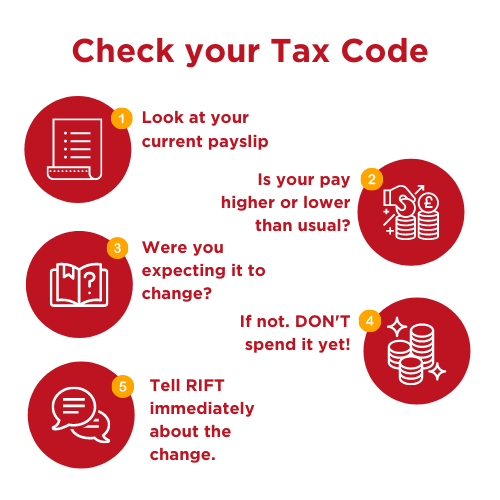

There are a few reasons why your tax code might change over time, and they’re not all things to worry about. However, it’s still worth keeping an eye out for changes in your code, since they could mean you’re suddenly paying the wrong amount of tax. HMRC will sometimes change your code after you’ve claimed a tax rebate, for instance. The idea is to make sure that you don’t overpay your tax in future years. However, if the work and travel expenses you’re claiming tax relief for change from year to year, you can easily end up with a tax code that doesn’t match your actual situation.

Being stuck on the wrong tax code can be a hassle. That’s why RIFT will always check your code automatically for you and get it fixed if it’s wrong. Meanwhile, if you spot a change in your code that looks wrong – or if you just don’t understand why it happened – give RIFT a call and we’ll sort it out for you.

Interested in claiming at tax rebate? Click the green button below.