How much money should I have saved by 18?

Friday 24th June 2022

What's it all about?

This article is designed to help you understand:

- The current climate for today's teenagers

- Hidden costs of being a parent

- How much to save for your child

Friday 24th June 2022

What's it all about?

This article is designed to help you understand:

Too long to read? Watch it here instead.

We release a new video every week on YouTube, subscribe to the channel so you don't miss out.

From the record-breaking mortgage rates in the late-70s right up to the recession of 2009, each generation has faced its own problems when growing up. In this guide, we’ll uncover what issues young people of today might face - and what this could mean for the parents of today.

Saving is hard enough without limited income and the temptation that comes with being young. As young people are often grouped together as 18 to 24-year-olds, it’s difficult to find any research based entirely on those aged 18 and under. This comes with its own problems. As you can imagine, someone who’s 24 and in employment may earn a lot more than an 18-year-old in full-time education.

A survey from the Resolution Foundation found that homeownership within this age group was at 28% in 2019 - a significant drop from the 51% peak in 1989. It was also found that just 4% of young people without a home had both the savings and salary to buy a home in their region.

Although this difficulty in getting on the property ladder seems reserved just to young people, it may also spill onto parents. Over the last three years, 34% of young people used gifts or loans from family and friends to purchase their first home. For comparison, this figure was 22% from 1995 to 1996.

These stats show the increasing difficulty for young people to pursue the life goals of previous generations. If the trend continues, it’s increasingly likely that you’ll need to help out your child if they are to own a home.

Turning 18 holds great significance. It’s a time full of promise and marks your journey to becoming an adult. You can register to vote, buy your first pint and even get married without parental consent. It may also be a time that your child looks to begin their undergraduate degree.

You’ve probably heard of the tuition fees that can cost upwards of £9,000 a year. Thankfully, the cost of this is covered by the Student Loans Company and will only begin to be paid back once your child earns over a set amount.

Maintenance loans work in a similar way although these are often used to cover day-to-day living costs such as transport and food. The maintenance loan amount is calculated on your household income, as technically, the more you earn the more you can afford to support your child.

Unless living at home, accommodation will be an extra cost that may have to be covered by yours truly. Times Higher Education found the average cost of accommodation to be just under £5,000 a year. As undergraduate degrees usually last three years, that’s £15,000 in total. If based in locations with high rent such as London, you could have to fork out even more.

This would be a scary cost to most parents, so we’ll help you figure out how much you’d need roughly to save for your child before they enter the big wide world.

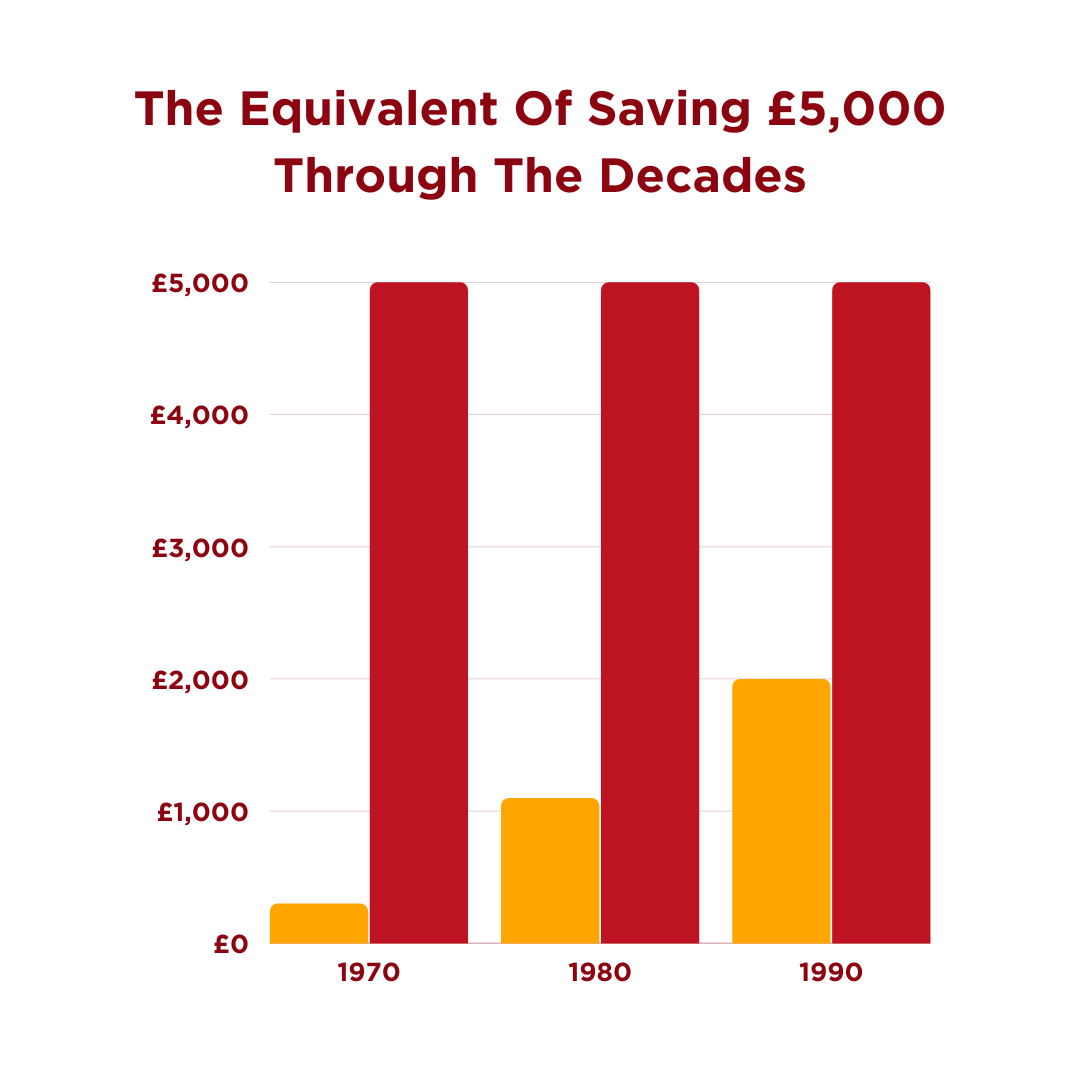

With 50% of young people now going to university, a flip of a coin would give you the same chance of your child wishing to go into higher education. To give some perspective on how much that £5,000 a year would’ve cost when you were younger, we’ve roughly worked it out by decade.

Depending on when you turned 18, it may be worth asking yourself if you would’ve had these amounts saved.

Even without university fees, just supporting a child until they reach 18 can cost a significant amount. A study by Child Poverty Action Group found the cost of raising a child to the age of 18 to be over £160,000 for a couple and £193,000 for a lone parent. That works out to be £9,000 a year for couples and £10,750 for a lone parent.

With the right information, you can help manage your money and plan for the future. If just starting out, we’d suggest watching our How to Save Money in the Bank video that goes into more details on how to save for short, mid and long term life goals.

It’s really important that we stress that this is a summary of the common scenarios that parents may face and not a definitive list. Often these amounts can differ depending on your personal circumstances. And remember, these are just a few of the options available to you. If you’re ever in doubt, speak to a financial advisor.

Of course you do! Get a grip on your cash with our money saving tips, guides and videos sent straight to your inbox.

Saving a significant chunk of money doesn't have to feel like a mountain to climb. In fact, you can build a decent nest egg in...

RIFTPROD1 - Subscriber